If you are aware of crowdfunding, hedge funds, venture funds, private placements, then you must’ve come across the term accredited investors. These investors hold most of the cards when it comes to making investments in complex offerings and unregistered securities and takes on more risk than the retail investor.

But what exactly is an accredited investor? How do they get verified? How are they different from non-accredited investors?

Let’s find out.

What is an Accredited Investor?

Accredited investors are those investors who are legally allowed by the SEC to trade in unregistered securities. Such investors often include-

- Financial Institutions such as brokerage firms

- High net-worth individuals

- Registered Investment Advisors

- Banks

- Trusts

Generally, these investors can deal in investment opportunities that are not available to non-accredited investors like private placements or unregistered securities as they offer varied advantages such as privacy, discretion, faster turnaround time and lower all-in cost.

What Does An Accredited Investor Do?

Accredited investors are allowed to go for the riskiest of the investment options (investments relating to Regulation D offerings) that are currently available in the market. Some of these investment opportunities are-

- Venture Capital Funds /Angel investments– Investments in startups, emerging companies with high growth potential.

- Hedge Funds– Pool of money to invest in more complex products such as derivatives.

- Real Estate Crowdfunding– Raising capital for real estate investments through crowdfunding.

- Real Estate Syndications- Pooling of intellectual and financial resources to purchase and manage a property.

How To Become An Accredited Investor?

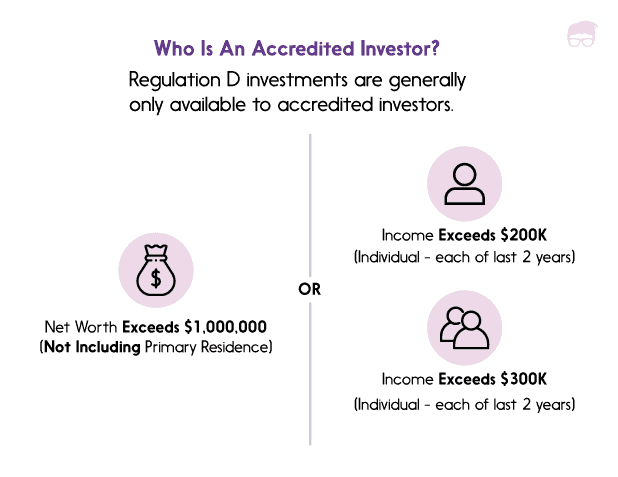

There are some requirements set out by SEC in Rule 501 of Regulation D to determine the status of an individual claiming to be an accredited investor. An individual must satisfy at least one of these requirements-

- (S)he must have a net worth of at least $1 million, excluding the value of the primary residence.

- (S)he must have an income of $200,000 per annum for the last 2 years and also expects to earn the same or higher in the current year. If married, the annual income should be $300,000 jointly. For all 3 years, the method for calculating the income should be the same, either single or joint.

Business entities, however, can be considered as accredited investors if their assets exceed a value of over $5 million or in which all of the equity owners are accredited investors.

However, there is no certification or process, per se, to verify the status of a potential investor. The authorized financial regulator does not review the credentials of every individual claiming to be an accredited investor. Instead, the companies that offer the unregistered securities perform the due diligence by asking for some documents such as-

- Tax Returns

- Bank Statements

- W-2

- Pay stubs

- Balance Sheet

- Letter from CPA or attorney

Why Is Accreditation Necessary?

The regulatory authority aims at protecting the interests of companies as well as the investors by maintaining fair and efficient markets. So the question is why these income restraints are justified in the market scenario, which is supposedly equivalent to all.

The reason is that accredited investors have a safety net to fall back on and withstand the risk of losing a substantial amount of money. The high-income criterion helps ensure that these investors have efficient funds to absorb the losses incurred.

Since private offerings and complex investments such as angel investments, hedge funds are quite risky, they pose a significant amount of risk to investors. If these ventures fail, then the losses to bear would be quite heavy. In order to pre-empt the losses and protect the interests of investors with little knowledge, experience and no buffer to rely on, this particular class of investment deals are offered to accredited investors only.

Accredited Investor vs Non- Accredited Investor

Roughly 9.86% of the American households meet the requirements set by the SEC for being an accredited investor. Rest are the non-accredited investors who do not meet those requirements.

Unlike accredited investors, non-accredited investors can’t invest in Regulation D investments like real estate crowdfunding and real estate syndication, and there are a lot of regulations against them investing in angel rounds of startups, VC firms, and hedge funds.

Pros And Cons Of An Accredited Investor

While being an accredited investor comes with its own perks like specialized investment opportunities, it also has its own cons.

Here are some of the advantages and disadvantages of being one –

Advantages

- Higher Returns – Accredited investors have access to private placements that offer a higher return on investment as compared to what is offered in the public capital market.

- Higher Yield- Accredited investors don’t have to depend upon dividend-paying stocks, bonds, REITs for higher yields. They can invest in private placements that offer higher yields.

- Diversification of Portfolio– As the stock market is quite volatile, the public capital market does not offer many options for the diversification of the portfolio. Accredited investors have access to such assets that are non-correlated to the market.

Disadvantages

- Higher Risk – The investments options like private placements, hedge funds, venture capital funds and angel investments are much more complex and risky. And because of inappropriate regulatory protection, these investors are exposed to a lot of scams.

- Illiquidity – Private offerings demand long term commitment which can often extend up to 5 years in case of real estate deals with no option of selling in the secondary market.

- Higher Fees – Private offerings demand excessive fees. This results in limiting their returns.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

![How To Get Startup Funding [The Complete Guide] startup funding guide](https://www.feedough.com/wp-content/uploads/2022/08/startup-funding-guide.webp)